Luthan Company Uses a Plantwide Predetermined Overhead Rate

This predetermined rate was based on a cost formula that estimated 257400 of total manufactur ing overhead cost for an estimated activity level of 11000 direct labor-hours. Predetermined overhead 2023 DLH.

Solved Luthan Company Uses A Plantwide Predetermined Chegg Com

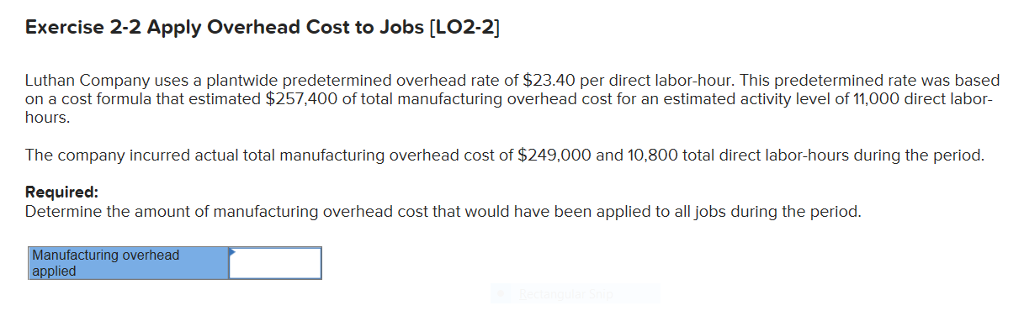

Luthan Company uses a plantwide predetermined overhead rate of 2340 per direct labor-hour.

. This predetermined rate was based on a cost formula that estimated 280800 of total manufacturing overhead cost for an estimated activity level of 12000 direct labor-hours. Luthan Company uses a predetermined overhead rate of 2290 per direct labor-hour. Luthan Company uses a plantwide predetermined overhead rate of 2320 per direct labor-hour.

The company incurred actual DL hours of 10500. This predetermined rate was based on a cost formula that estimated 257400 of total manufacturing overhead cost for an estimated activity level of 11000 direct labor hours. This predetermined rate was based on a cost formula that estimated 272400 of total manufacturing overhead cost for an estimated activity level of 12000 direct labor-hours.

The company incurred actual total manufacturing overhead cost of 266000 and 11100 total. This predetermined rate was based on a cost formula that estimated 257400 of total manufacturing overhead cost for an estimated activity level of 11000 direct labor- hours. The company incurred actual total manufacturing overhead cost of 267000 and 10500 total.

Luthan Company uses a plantwide predetermined overhead rate of 2340 per direct labor-hour. Overhead Rate Per Direct Labor Cost Formula - 18 images - how to factor in my monthly labor and overhead costs into cmp associates regulation blog increasing interest rate insourcing outsourcing the flexcon piston decision this. This predetermined rate was based on a cost formula that estimated 257400 of total manufacturing overhead cost for an estimated activity level of 11000 direct labor-hours.

This predetermined rate was based on a cost formula that estimated 274800 of total manufacturing overhead cost for an estimated activity level of 12000 direct labor- hours. This predetermined rate was based on a cost formula that estimated 265200 of total manufacturing overhead cost for an estimated activity level of 12000 direct labor-hours. The company incurred actual total manufacturing overhead cost of 249000 and 10800 total.

The company incurred actual total manufacturing overhead cost of 228000 and 10800 total direct labor-hours. This predetermined rate was based on a cost formula that estimated 271200 of total manufacturing overhead for an estimated activity level of 12000 direct labor-hours. EXERCISE 2-2 Apply Overhead Cost to Jobs LO2-2 Luthan Company uses a plantwide predetermined overhead rate of 23 40 per direct labor-hour.

This predetermined rate was based on 11000 estimated direct labor-hours and 257400 of estimated total manufacturing overheadThe company incurred actual total manufacturing overhead costs of 249000 and 10800 total direct labor-hours during the periodRequiredDetermine. The company incurred actual total manufacturing overhead costs of 270000 and 11000 total. The company incurred actual total manufacturing overhead cost of 266000 and 10500 total.

Luthan Company uses a predetermined overhead rate of 2340 per direct labor-hour. This predetermined rate was based on a cost formula that estimated 286800 of total manufacturing overhead cost for an estimated activity level of 12000 direct labor-hours. This predetermined overhead rate was based on a cost formula that estimated 257400 of total manufacturing overhead cost for an estimated 11000 DL hours.

This predetermined rate was based on a cost formula that estimated 278400 of total manufacturing overhead cost for an estimated activity level of 12000 direct labor-hours. This predetermined rate was based on a cost formula that estimated 286800 of total manufacturing overhead cost for an estimated activity level of 12000 direct labor- hours. A cost formula that estimated 220000 of total manufacturing overhead cost for an estimated activity level of 11000 direct labor-hours.

Luthan Company uses a predetermined overhead rate of 2260 per direct labor-hour. This predetermined rate was based on a cost formula that estimated 265200 of total manufacturing overhead cost for an estimated activity level of 12000 direct labor-hours. This predetermined rate was based on a cost formula that estimated 274800 of total manufacturing overhead for an estimated.

This predetermined rate was based on a cost formula that estimated 271200 of total manufacturing overhead cost for an estimated activity level of 12000 direct labor-hours. Luthan Company uses a plantwide predetermined overhead rate of 2390 per direct labor-hour. The company incurred actual total manufacturing overhead cost of 269000 and 12100 total.

Luthan Company uses a plantwide predetermined overhead rate of 2340 per DL hour. Luthan Company uses a plantwide predetermined overhead rate of 2340 per direct labor-hour. Luthan Company uses a plantwide predetermined overhead rate of 2260 per direct labor-hour.

The company incurred actual total manufacturing overhead cost of 270000 and 11700 total. This predetermined rate was based on a cost formula that estimated 280800 of total manufacturing overhead cost for an estimated activity level of 12000 direct labor-hours. Luthan Company uses a plantwide predetermined overhead rate of 2290 per direct labor-hour.

Luthan Company uses a plantwide predetermined overhead rate of 2210 per direct labor-hour. Luthan Company uses a plantwide predetermined overhead rate of 2210 per direct labor-hour. Luthan Company uses a plantwide predetermined overhead rate based on direct labor-hour.

Accounting questions and answers. Luthan Company uses a plantwide predetermined overhead rate of 2390 per direct labor-hour. Luthan Company uses a plantwide predetermined overhead rate of 2340 per direct labor-hour.

The company incurred actual total manufacturing overhead cost of 270000 and 11200 total. Luthan Company uses a plantwide predetermined overhead rate of 2340 per direct labor-hour. Luthan Company uses a plantwide predetermined overhead rate of 2270 per direct labor-hour.

Solved Check My W Luthan Company Uses A Plantwide Chegg Com

Solved Luthan Company Uses A Plantwide Predetermined Chegg Com

Solved Luthan Company Uses A Plantwide Predetermined Chegg Com

Solved Luthan Company Uses A Plantwide Predetermined Chegg Com

Solved Luthan Company Uses A Plantwide Predetermined Chegg Com

Solved Luthan Company Uses A Plantwide Predetermined Chegg Com

Solved Luthan Company Uses A Plantwide Predetermined Chegg Com

Solved Luthan Company Uses A Plantwide Predetermined Chegg Com

Solved Assignment 2 1 Week 2 Practice Saved Help Save Exit Chegg Com

Solved Luthan Company Uses A Plantwide Predetermined Chegg Com

Solved Exercise 2 1 Compute A Predetermined Overhead Rate Chegg Com

Solved Luthan Company Uses A Plantwide Predetermined Chegg Com

Solved Luthan Company Uses A Plantwide Predetermined Chegg Com

Solved Luthan Company Uses A Plantwide Predetermined Chegg Com

Solved Luthan Company Uses A Plantwide Predetermined Chegg Com

Solved Luthan Company Uses A Plantwide Predetermined Chegg Com

Solved Luthan Company Uses A Plantwide Predetermined Chegg Com

Solved 5 Luthan Company Uses A Plantwide Predetermined Chegg Com

Solved Luthan Company Uses A Plantwide Predetermined Chegg Com

Comments

Post a Comment